Learners

Whether you want to be a business leader, a key financial decision maker or even an entrepreneur, there’s one career path that can get you there: chartered accountancy.

If you dream of becoming a chartered accountant (CA(SA), here is all the information you need:

- The chartered accountancy profession

- What it takes to study towards the CA(SA) designation including details on the five the steps you need to take to qualify as a CA(SA), and Information about SAICA’s very own bursary fund – the Thuthuka Bursary – and how to apply if you qualify

What is a CA(SA) and how do you become one?

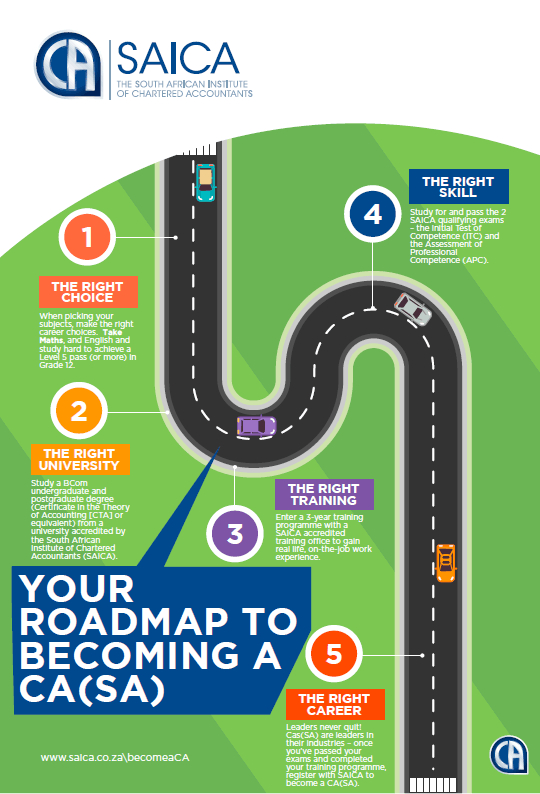

Roadmap to becoming a CA

Become a difference maker

What kind of tomorrow do you want to shape?

A connected world, working together to prosper and thrive?

Well, if you want an exciting career where you can contribute to something bigger than yourself, becoming a chartered accountant (CA(SA)) puts you in a position to make a real difference, giving you the skills and perspectives to build the tomorrow you want.

Compelling reasons to consider CA(SA) as YOUR career path

The CA(SA) designation is your passport to:

- Changing the world – As difference makers, CAs(SA) have the skills, knowledge and insight to drive business decisions that help create better societies, economies and communities – for a more prosperous future for us all

- Being the head and heart of a business – CAs(SA) are not only able to run companies (74% of the JSE’s Top 200 company chief financial officers (CFOs) and almost a third of the Johannesburg Stock Exchange’s top 40 CEOs are CAs(SA) they are able to start their own companies and be their own boss too. And that means you can make your passion a reality

- A highly promising and varied career – As a CA(SA) you can work in just about any industry of choice – in all fields of business and finance and, more specifically, in auditing/assurance, tax, financial management, information technology, management accounting, forensic accounting and insolvency, as well as academia, public and private sector, NGOs and more

- An internationally recognised career

- Improving your chances of being head-hunted by top employers throughout your career

- CAs(SA) hold prestigious positions in the private and public sectors and in academia

- Contributing to making South Africa a better place through giving back in a number of different ways

How do you become a CA(SA)?

The minimum requirements for university admission to a CA-stream BCom degree are a Level 5 pass in Mathematics, together with a National Senior Certificate with matriculation exemption. You need to take pure Mathematics (not Mathematical Literacy) as a subject and you need to pass it well. That means achieving 60% or more.

You also need a good grounding in English, as it will help you to understand the concepts you will study.

Many learners believe that having Accounting as a school subject is compulsory to study towards your CA(SA). While it can help you in your studies towards your degree, it isn’t necessary.

Now let’s talk universities …

If you want to be a CA(SA), you need to ensure that the university you’re applying to offer a BCom qualification/programme that is endorsed by the South African Institute of Chartered Accountants (SAICA).

Once you’ve completed the three-year degree, you’ll need to obtain a Postgraduate Diploma in Accounting (PGDA or honours equivalent). This is a postgraduate course – your fourth year at university – and focuses on Accounting, Auditing, Taxation and Financial Management. It takes a minimum of one year to complete and must be completed at a SAICA-endorsed university.

Once you have your BCom, it’s time to get real-world working experience. Following your PDGA, you’ll enter into a three-year training contract with a SAICA-registered training office.

During you training, you must pass two qualifying examinations: the Initial Test of Competence (ITC) and the Assessment of Professional Competence (APC).

If you pass everything first time, the entire qualification process takes about seven years from the time you enter university. Now that may sound like a long time, but it’s worth it.

Where can you make a difference as a qualified a CA(SA)?

The CA(SA) journey equips you with exceptional commercial acumen, professional scepticism, critical thinking and the ethical framework you need to shape your world.

And that means that you don’t just have to do traditional accounting work. Studying to become a CA(SA) opens up a LOT of doors here in SA and internationally including:

- Auditing: CAs(SA) generally audit financial statements and provide tax or financial planning advice. They also offer consulting and advisory services in a variety of fields such as corporate finance, management accounting, information technology and general financial and business management

- Business: CAs(SA) can specialise in management accounting, financial management, taxation, corporate governance, internal audit and many other fields. Many lead major companies as chief executive officers, chief financial officers and managing directors

- Government and the public sector: CAs(SA) hold top-notch positions (like the Auditor-General or Head of National Treasury) and are widely recognised for effective financial management, leadership and providing services to their country

- Academia: become a lecturer and develop the next generation of CAs(SA) by lecturing at universities and providing training through professional programmes

- Entrepreneurship: follow the entrepreneurial route and become your own boss!

The bottom line is if you choose well and work smart, you too can be a difference maker because you’re a CA(SA)!