Legal and Policy - 10 August 2023

Description

SARS:

- 8 August 2023 – RFP02/2023: The provision of cleaning consumables, chemicals, and industrial cleaning equipment to the South African Revenue Service (SARS) offices nationwide

- 8 August 2023 – RFP09/2023: Appointment of the service provider for the provision of electric forklifts for the period of five (5) years

- 7 August 2023 – The latest VAT Connect Newsletter Issue 16 is now available. This issue includes information on recent amendments, documentary requirements for repossession and surrender if goods, the new dispute resolution process, changes to the VAT registration process, commercial accommodation arranged via Apps and platforms and domestic reverse charge regulations.

- 7 August 2023 – The following SARS branches are affected by this week’s taxi strike: Bellville, Cape Town and Mitchells Plain. Until further notice and to protect the safety of our staff and taxpayers, the branches will only be able to assist with eBooking appointments. Our apologies for the inconvenience.

- 7 August 2023 – The SARS Sibasa branch in Limpopo is closed today Monday, 8 August 2023 due to water maintenance. Staff will assist taxpayers virtually, where possible. Our apologies for the inconvenience.

- 5 August 2023- SARS Commissioner Kieswetter has noted the media coverage concerning the liquidation of Tariomix.

The allegations of SARS officials, although unclear, of complicity are taken very seriously and are being investigated by the SARS Anti-Corruption Division. If there is any truth to the allegations, SARS will deal with the officials promptly and harshly.

Commissioner Kieswetter wishes to state that he has been briefed on the matter and cautions against media speculation as there are other factors, that relate to the liquidation, which demand investigation and may, potentially, lead to legal proceedings being initiated.

At this time, the Commissioner cannot provide any further commentary except to assure the public that any form of corruption will be thoroughly dealt with decisively.

For further information, please contact SARS at SARSMedia@sars.gov.za

- 4 August 2023 – The PAYE BRS for Employer Reconciliation version 22 1 2 is now published (previous version was 22 1 1). The validation rules for “Reason for non-deduction of tax” (source code 4150) have changed.

- 4 August 2023 – Companies Act, 2008

Winding-up application – business rescue application launched thereafter – stratagem to avoid winding-up – business rescue application an abuse of court process – applicants in business rescue application non-suited – winding-up order correctly granted.

- 4 August 2023 – Customs and Excise Act, 1964: Publication details for tariff amendment notice R3744, as published in Government Gazette 49068 of 4 August 2023, are now available.

- 4 August 2023 – The mobile tax unit schedules for Limpopo province during August is now available.

- 4 August 2023 – SARS would like to exchange declaration information electronically with other government agencies (OGAs) when imported or exported goods have been detained for inspection by them. When applying for an importer or exporter client types these applicants are therefore required to:

Grant SARS consent; or

Refuse consent.

The facility codes used in Box 30 on the Customs Clearance Declaration (CCD) have been updated to change the name Gridrod SA (Pty) Ltd. to Grindrod SA (Pty) Ltd.

Updated guide and annexure:

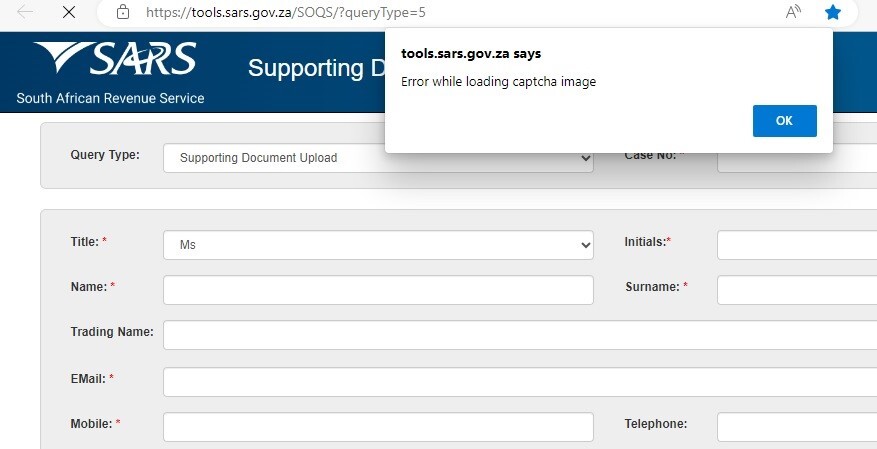

- 4 August 2023 – Certain Tax Practitioners and Taxpayers are unable to upload supporting documents to the SARS Online Query System (SOQS) due to a CAPTCHA error – see below image.

This is resolved by clearing the browser cache. See these easy steps to clear different browsers.3 August 2023 – Customs and Excise Act, 1964: Publication details for tariff amendment notice R3747, as published in Government Gazette 49072 of 3 August 2023, are now available.

- 3 August 2023 – Customs Weekly List of Unentered Goods

- 3 August 2023 – You will recall that in the past SARS has been issuing and certifying both 12 and 13 blocks SCO for goods destined within SADC Countries. In 2020 SARS requested the SADC members states to gradually phase-out the 12 blocks SCO in compliance with the record of the decisions of the 28th meeting of the Ministers of Trade that was taken in 2016, Gaborone, Botswana.

The transition from the 12 to 13 blocks SCO took a considerable period due to excess stock. Now that SARS and Traders have limited stock of the 12 blocks SCO, it is now an opportune time to transition to the 13 blocks SCO in compliance with the 28th Ministerial decision.

For more information, see our letter to Trade.

- 3 August 2023 – The tax workshop schedules for Gauteng South during August is now available.

- 3 August 2023 – Customs and Excise Act, 1964: The tariff amendment notice, scheduled for publication in the Government Gazette, relates to the amendments to –

- Part 1 of Schedule No. 1, by the substitution of tariff subheadings 1701.12, 1701.13, 1701.14, 1701.91, and 1701.99, to reduce the rate of customs duty on sugar from 195,28c/kg to free of duty in terms of the existing variable tariff formula – ITAC Minute 03/2023.

Publication details will be made available later.

NATIONAL TREASURY:

- Media Statement: Energy Bounce Back Loan Guarantee Scheme – 8 August 2023

- Energy Bounce Back Scheme FAQs – 8 August 2023

OECD:

- Policy Guidance on Mitigating the Risks of Illicit Financial Flows in Oil Commodity Trading - 8 August 2023

ATAF:

- Nigeria to lead ATAF Technical Committee on Exchange Information – 5 August 2023

| Author | Legal and Policy |

|---|---|

| Division | Legal and Policy |

| Categories | Legal and Policy |

| Date | 10 August 2023 |