Legal and Policy - 13 October 2022

Description

SARS:

- 12 October 2022 - South Africa will be introducing an online traveller declaration system to simplify passenger movement at South African airports. The new system requires all travellers, including South African citizens and residents, children and infants, leaving or entering South Africa by air to complete and submit an online traveller declaration, as well as receive a traveller pass before they travel.

The new traveller declaration process is an online system that collects travel information and returns a traveller pass via email. Upon arrival in South Africa, there will be instructions at the airports that will guide and inform travellers what to do next. The new online South African Traveller Declaration system will be rolled out to all South African international airports commencing with OR Tambo International Airport in November 2022, followed by other international airports in the first quarter of 2023.

- 12 October 2022 – RFP17/2022: Establishment of Security Assessment Services Panel

The following documents are now available:

- 12 October 2022 – Extension of closing date for RFP17/2022: Establishment of Security Assessment Services Panel

Please note that the closing date for the abovementioned bid has been extended to Monday, 31 October 2022 at 11H00. Click here to view the extension letter.

- 12 October 2022 – Due to the fact that the Master of High Court (MOHC) issues the same number for two or more Trusts formed through a single Will, SARS has introduced a workaround to ensure that these separate Trusts are uniquely identified as a taxpayer. Below is a summary of the process that SARS follows in such an instance:

For a Trust, where a duplicate (or more) Trust Registration Number from the MOHC is identified:

- Add a suffix “A” for the duplicate MOHC Trust Registration Number, followed by an increasing numerical value starting with “01”.

- For example – Trust number (MT14695/2017 by MOHC) allocated to different Trusts

- Allocate the numbers as follows for entity registration purposes:

- 1st Trust – MT146952017A01

- 2nd Trust – MT146952017A02

- Capture the Trust name as reflected on the Letter of Authority and ensure that the correct trust type is captured

- Note: A Trust can have more than one beneficiary in a Trust. However, a Trust is a one legal entity and only one trust must be registered irrespective of the number of beneficiaries.

See our Trusts webpage here for more information.

- 10 October 2022 – Update on Tax Directives enhancements in line with Financial Sector Conduct Authority (FSCA) were implemented

The South African Revenue Service (SARS) implemented enhancements to the Tax Directives process on 16 September 2022 by validating the name of the fund at Financial Sector Conduct Authority (FSCA) as well as the number with the FSCA database.

Where Funds and Fund Administrators experience spelling errors between information on the FSCA website that is not aligned with your FSCA registration letter, a request to correct the spelling error must be sent to the following contact person: Jodine Scholts at jodine.scholtz@fsca.co.za at the FSCA. Please note that this email address is only for the correction of spelling errors of names.

All other issues relating to the FSCA, must be directly addressed with the FSCA via the existing channels available to the Funds and Fund Administrators.

You are advised to continue using the name exactly as it is listed on the FSCA website until the changes on the name have been effected to avoid a rejection of the directive application.

- 10 October 2022 – If you want to make a virtual booking, you can do it in ANY branch/region. It doesn’t not have to be where you reside. When you have selected a branch under ‘Preferred Branch’ and the system returns a message ‘The selected Province or Branch do not have available appointment slots….‘ then please select another Province and/or Branch.

- 10 October 2022 – Tax Administration Act, 2011

CSARS v Airports Company for South Africa (Case no 785/2021) [2022] ZASCA 132 (7 October 2022)

Tax Administration Act 28 of 2011 – application for amendment to objection against an additional assessment – no procedure in the Act for amendment of an objection – taxpayer not entitled to amendment in terms of Uniform rule 28(1), read with rule 42(1), of the tax court rules

- 10 October 2022 – Customs & Excise Act, 1964: The rule amendment notice R2576, as published in Government Gazette 47254 on 7 October 2022, relates to the amendment to the rules under sections 44 and 120 – Amendment to rule 00.05, insertion of rule 44.05 and substitution of forms SAD 502 and SAD 505 in the Rules to the Customs and Excise Act, 1964 (DAR240)

- 7 October 2022 – National Legislation

Section 11D of the Income Tax Act, 1962 – Draft refinements to the research and development tax incentive

Draft Explanatory Memorandum – Refinements to the research and development tax incentive

Due date for comment: 7 November 2022

- 7 October 2022 – Customs & Excise Act, 1964: Publication details for the following tariff amendment notices are now available:

R2575 as published in Government Gazette 47254

R2605 as published in Government Gazette 47262

- 7 October 2022 – Please note that the Production platforms for both Secure File Gateway and Connect:Direct will be temporarily offline for planned maintenance between 03:00 and 05:00 on Saturday 08 October 2022. Please do not submit any files in the Production environment during this time, as they will not be processed.

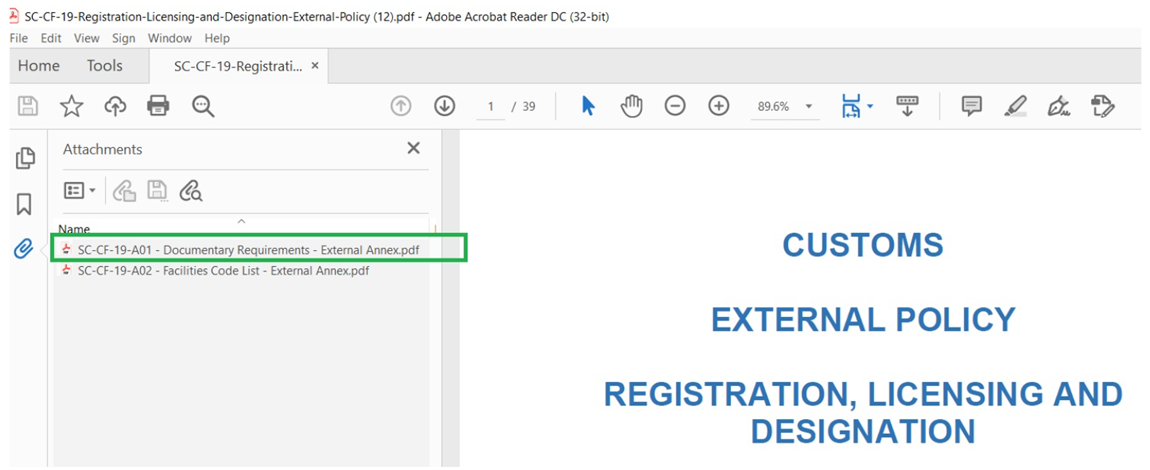

- 7 October 2022 – Reminder of the required supporting documents when applying for a Customs client type. In the SC-CF-19 – Registration, Licensing and Designation Policy is an Annexure document called SC-CF-19-A01 – Documentary Requirements – External Annex. Open the Policy and click on the Annex opening in the left panel:

- 6 October 2022 – Updated list of the approved Venture Capital Companies

- 6 October 2022 – Invitation to webinar on Allowable Medical Expenses

SARS would like to invite you to attend a webinar on Allowable Medical Expenses which aims to clarify any questions on the topic. and complete a short survey at the end of the webinar. At the end of the session, you will be asked to complete a short survey to assist SARS in developing more helpful and relevant education interventions for you and other taxpayers. For more information on the webinar click here.

Webinar details:

Theme: Allowable Medical Expenses

Date: Thursday, 6 October 2022

Time: 17:00 – 19:00

YouTube: https://youtu.be/YAAPPDqXb5s

Click here to view the presentation.

- 6 October 2022 – Customs & Excise Act, 1964: The tariff amendment notices, scheduled for publication in the Government Gazette, relate to the amendments to –

Part 1 of Schedule No. 2, by the substitution of anti-dumping item 215.02/7324.10/03.06, in order to give effect to the name-change of the manufacturer/exporter excluded from the payment of anti-dumping duties on stainless steel sinks originating in or imported from the People’s Republic of China – ITAC Minute 06/2022 (with retrospective effect from 3 December 2021); and

the General Notes in Schedule No. 1, by the deletion of the references in Note O.1 pertaining to “Arab Republic of Egypt” and “Democratic Republic of Sao Tome and Principe”, the date of implementation and phasedown period applicable to these two countries (with retrospective effect from 1 January 2021).

Publication details will be made available later

- 6 October 2022 – RFP 22/2022: The Establishment of a Panel for Printing, Labelling and Packaging for Communication Material Services

The tender has been updated with the following documents:

- 6 October 2022 – The October 2022 Mobile Tax Unit schedule for Western Cape is now available.

NATIONAL TREASURY:

- Media Statement R6.2bn new commitments for Just Energy Transition and Skills Development – 7 October 2022

- Media Statement: Draft Refinements to the Research and Development Tax Incentive – 7 October 2022

Draft changes to the Research & Development Tax Incentive for Public Comment – 7 October 2022 - Media statement: Designation of Acting Tax Ombud – 7 October 2022

OECD:

- OECD presents new transparency framework for crypto-assets to G20 - 10 October 2022

TAX OMBUD:

- Nine Years of Ensuring Fairness – 12 October 2022

- Tax Ombud’s Annual Report 2021/2022 – 12 October 2022

- Media Statement: Designation of Prof. Thabo Legwaila as Acting Tax Ombud – 7 October 2022

SAFLII:

| Author | SAICA |

|---|---|

| Division | Legal and Policy |

| Categories | Legal and Policy |

| Date | 13 October 2022 |